In the US, this means walking a tightrope between sales and clients (or sales and traffic) while avoiding the wrong side of tax compliance. Invoicing miscalculations—even small ones—can trigger penalties, audits, or cash flow disruptions. Rather, this is where a tax-compliant invoicing app for businesses acts as a game-changer. This not only makes billing easier for you but also ensures accuracy, compliance, and stress-free taxes.

Here are the three things every small business owner should know about safeguarding their business from costly tax mistakes with the right invoicing technology to continue to grow and run their business efficiently with this guide.

Tax Errors: A Bigger Risk Than You May Realize

US tax law can be quite complicated, especially for small business owners, freelancers, and businesses experiencing rapid growth. Even though mistakes like incorrect tax rates, missing information, or bad record-keeping happen unknowingly, they can still lead to:

- IRS penalties and fines

- Delayed payments or rejected invoices

- Complications during audits

- Lost time correcting past invoices

A tax-compliant invoicing app for businesses takes these risks out of the process, as it automates the tax calculations that a business should be doing and guides the user to ensure the invoices fulfill the regulatory standards outlined above.

What Is a Tax-Compliant Invoicing App?

A Tax-Compliant Invoicing App for Businesses is an online billing solution that creates invoices that comply with up-to-date tax regulations. They automatically compute relevant taxes, keep accurate records, and adjust compliance rules seamlessly with a statutory change.

Similar to the benefits of manual invoicing and spreadsheets, these apps offer a lower rate of human error, but they provide a greater level of visibility and control over your financial data.

Benefits of Automated Invoicing: Things to Avoid in Tax

Build Tax Calculations You Can Rely on Automated

With an automated tax invoicing solution, tax calculations are no longer a guessing game. The right rates are applied every time, be it sales tax or other relevant charges, thus minimizing chances of not charging or overcharging clients.

Built-In Compliance Standards

Whether it is VAT-compliant invoicing software or US tax-ready formats, all the necessary information goes into your invoices as a default—business info, tax breakdowns, invoice numbers, dates, and more—keeping you audit-ready at all times.

Advantages for Small Companies and Freelancers

Invoicing App for Small Businesses

Accounting resources available to small businesses tend to be limited. A small business invoicing app that takes the hassle out of daily billing and avoids pesky tax errors, so you can spend less time on paperwork and more time growing your business.

Invoicing App for Freelancers

Freelancers have different challenges, like having multiple clients and income that changes a lot. For freelancers, an invoicing app guarantees that each invoice is professional, legal, and tax-season-ready.

Why Does Cloud-Based Invoicing Software Bring a Change?

The cloud-based invoicing software allows you to create and view invoices anytime. Which is particularly useful for remote teams and mobile professionals.

- Key advantages include

- Secure data storage

- Transactions and tax records are available on demand.

- Keep Your Peace of Mind With Automatic Backups

- Easy collaboration with accountants

This can be a godsend when tax deadlines come around: cloud access means you are always ready!

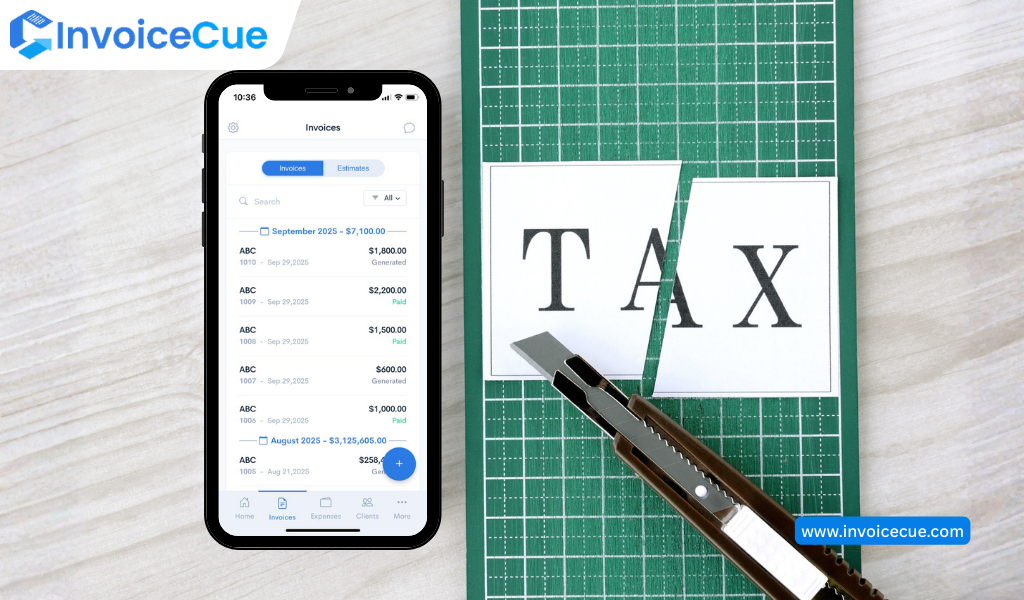

Download the InvoiceCue app today, available on Android and iOS.

Reducing Errors with Real-Time Updates

Tax regulations are subject to change, and keeping track of them manually is burdensome. Modern tax-compliant invoicing apps for businesses always automatically update compliance rules so the invoices you issue remain tax-compliant as per the prevalent standards without you having to make any extra provisioning.

Quick Payment and Improved Cash Flow

Paid-on-time invoices that are accurate and comply with existing regulations. One can avoid unwanted disagreements in the breakdown and calculation of taxes with something so simple; a clear tax breakdown eliminates chances of a dispute between the client and accountant. This allows for swifter remittances and better cash flow for your business.

Helping Your Business Scale With Better Invoicing

With the growth of your business, it is a tedious task to manage invoices manually. As your business grows, so does the number of invoices you send out—a scalable, automated tax invoicing solution will seamlessly scale with you and provide you with the same level of accuracy and compliance regardless of the volume.

Conclusion

Dealing with tax compliance need not be distressing. An invoicing app with tax compliance for business means that each invoice is tax compliant, professionally written, and compliance-ready. This makes it not only a crucial tool for the US modern business, but saving time, reduces errors, and optimizes cash flow.

FAQs on Tax-Compliant Invoicing App for Businesses

1. How does a tax-compliant invoicing app help avoid tax penalties?

A tax-compliant invoicing app for businesses automatically applies correct tax rates, includes mandatory invoice details, and maintains accurate records—reducing errors that often lead to penalties.

2. Is an invoicing app suitable for freelancers and small businesses?

Yes. An invoicing app for small businesses and freelancers simplifies billing, saves time, and ensures every invoice meets tax requirements without needing accounting expertise.

3. Can cloud-based invoicing software replace manual bookkeeping?

While it doesn’t replace an accountant, cloud-based invoicing software significantly reduces manual bookkeeping by automating invoices, tracking taxes, and organizing financial data in one place.